Audet & Partners, LLP reports that the U.S. Supreme Court has decided not to review a lower Federal court opinion that held private debt collectors subject to New York State interest laws even when the debt firms had shown that the debt was acquired from a national bank. Earlier this year, the Office of the Comptroller of the Currency and the U.S Solicitor General’s Office had argued that state usury laws, or the maximum lenders can legally charge for interest on loans, were inapplicable when the loan was acquired from a national bank.

The previous Second Circuit Court of Appeals ruling in a debt collector lawsuit in May 2015 had revived a class action brought by consumers in New York against Midland Funding LLC and Midland Credit Management Inc., both units of Encore Capital Group. The consumers had argued that the debt firms had violated New York usury laws as the interest rates on the debt they were seeking to collect exceed legally permissible limits in New York.

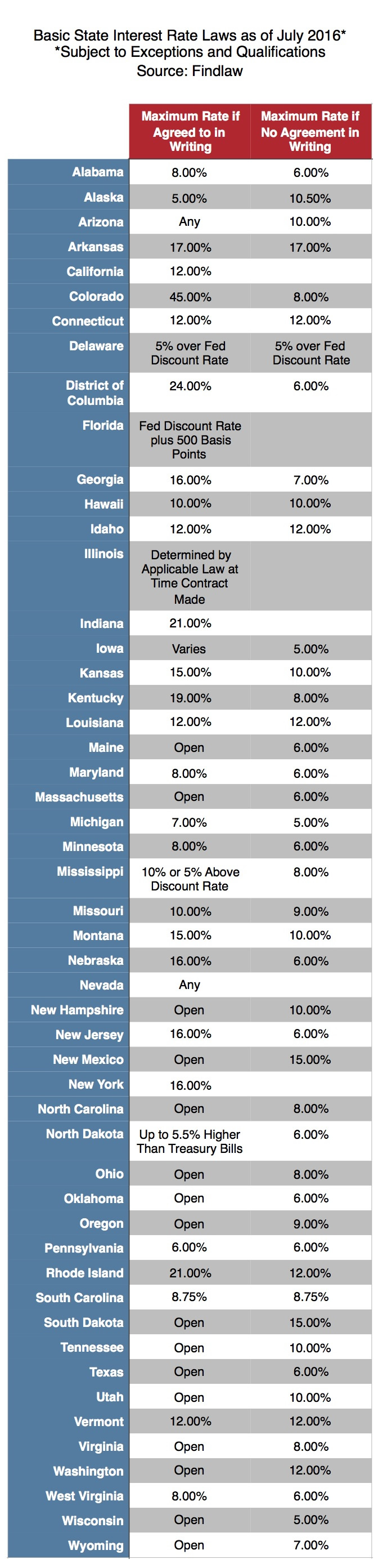

As shown in our table below, New York has in place a usury limit of 16% which the consumers in the class action was being exceeded by the debt collectors. One plaintiff in the class action alleged that Midland had been charging 27% interest on more than $5,000 in unpaid credit card debt that Midland had acquired from Bank of America. His attorney successfully argued that Bank of America was not immune from state usury laws despite the National Bank Act which in many areas shields National banks from state regulation.

Visit our page regarding consumer protection and fraud law for more information about this practice.

The law firm is no longer accepting clients in this case.